July 18, 2012 (JS Research)

Post the demerger of ICI Pakistan (ICI) and its paints business (AKZO); we share our valuations for both the stocks. ICI’s stock price has appreciated by 14% in the three trading sessions following resumption in its trading. We believe the reduction in its paid-up capital by 33% has fueled speculation of a higher EPS, going forward. However, investors have failed to incorporate the deteriorating business fundamentals, in our view. Low margins in the polyester (PSF) business and gas curtailment are likely to dilute the impact of lower paid-up capital following the demerger. Moreover, our crude estimate suggests that valuations for AKZO are extremely stretched. Hence, we recommend to book profits in both these stocks. Key risks to our calls on ICI and AKZO are 1) a tender offer by the acquirer of the AkzoNobel stake in ICI and 2) a one time heavy cash payout by AKZO.

Brief history of the demerger

ICI announced the demerger of its paints business in April 2011 contingent to regulatory approval. AkzoNobel after conducting a strategic review of its businesses in Pakistan concluded that the paints business offers opportunity to create value within its transformed portfolio and strategic ambitions. Hence, AkzoNobel decided to divest its shareholding in ICI post the demerger.

As per the scheme of arrangement, the paid up shares of ICI will be reduced by ~33% to 92.36mn. The Paints undertaking (AKZO) will have 46.44mn paid-up shares. The shareholder of ICI (before the demerger) holding 100 shares will receive 33 shares of AKZO and 67 shares of ICI.

ICI: drag in profits due to weak fundamentals

1Q2012 review: Incorporating the effects of demerger, ICI earnings in 1Q2012 clocked in at Rs1.71/share from continuing operations (a decline of 53%YoY). One of the main reasons for the drop in earnings was a fall of 15%YoY in the net revenues of the company. Lower overall revenues were owing to a decline of 27%YoY in net sales of the company’s PSF business due to lower cotton prices. Also, gross margin for ICI contracted to 9.9% in 1Q2012 from 11.8% in 1Q2011 owing to use of expensive furnace oil amid gas shortages.

Earnings expectations: With a likelihood of further deterioration in the gas situation in the country (particularly in the upcoming winters), we expect earnings to remain under pressure at least until March 2013. The expected commissioning of two coal fired boilers in March 2013 for its soda ash plant should provide some respite. Also, the financial charges are likely to increase going forward as the company will be relying on bank borrowings to make a payment of Rs3.7bn to AKZO (presently ICI has Rs2.8bn cash) and loss of cash generation from the paints segment. Hence, we expect earnings to clock in at Rs13.1/share and Rs16.2/share in 2012E and 2013F, respectively. We also expect the company to cut back on its payout ratio due to liquidity constraints.

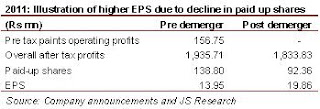

Outlook: ICI’s stock has appreciated by 14% in the three trading sessions following resumption of its trading. We believe, expectation of a higher EPS due to lower paid-up shares as paints contributed negligibly to overall profitability has resulted in investor excitement (see illustration).

The stock trades at a 2012E PE of 11.4x, which is at a premium of 28% to its 3-year historical average. Our valuation for ICI stands at Rs138 and we recommend to book profits in the stock. However, with AkzoNobel looking to offload its 75.8% stake in the company, any potential tender offer by the acquirer may generate future excitement in the stock. Interestingly, a news item suggests that KP Chemicals may bid as much as WON400bn, which translates into a value of Rs474/share.

AKZO: Potential for growth, though vals stretched

1Q2012 review: AKZO reported an operating loss of Rs12mn in 1Q2012. The paints market had remained sluggish due to prolonged winters, energy crisis and poor law and order situation. However, the company managed to report earnings of Rs0.76/share on account of Rs54.7mn income booked on receivables from ICI. We expect this to be a non-recurring item for AKZO. However, retention of cash received from ICI could result in an annual upside of ~Rs5.5/share.

Earnings expectations & outlook: Our crude estimates for AKZO suggest EPS of ~Rs7 for 2012E, translating into a PE of 16.0x. Based on this our value for AKZO stands at Rs100, hence we advise to book profits. Although speculation is rife that AKZO may payout a exciting payout from the receipt of Rs3.7bn from ICI; possibility of setting up a manufacturing unit from it to export to Middle East remains high.

+92 (21) 111-574-111 (ext: 3118)

No comments:

Post a Comment